Cash Application Specialist jobs, Employment

Contents:

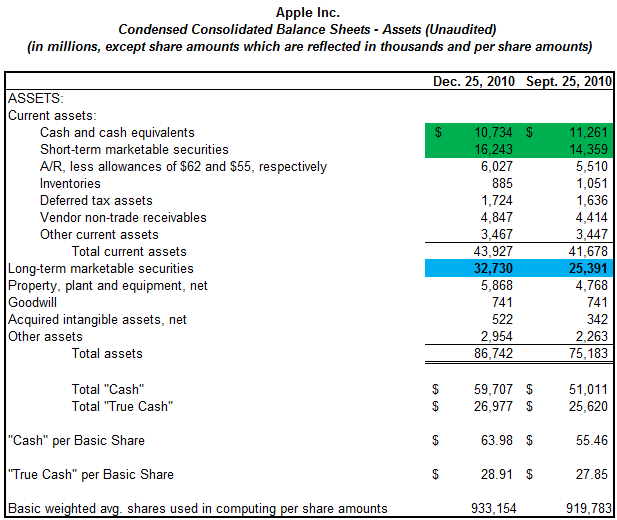

The direct write-off methodology isn’t permissible under Generally Accepted Accounting Principles. Accounts receivable and notes receivable that outcome from firm sales are known as commerce receivables, however there are different forms of receivables as nicely. For instance, curiosity income from notes or different curiosity-bearing property is accrued on the end of each accounting interval and positioned in an account named curiosity receivable. The whole dollar quantity of all receivables is multiplied by this p.c to get the estimated greenback amount of uncollectible accounts—reported within the stability sheet as the Allowance for Doubtful Accounts. When an organization immediately grants credit score to its prospects, it expects that some customers won’t pay what they promised. The accounts of these clients are uncollectible accounts, commonly known as dangerous debts.

Cash application is a part of the accounts receivable process that applies incoming payments to the correct customer accounts and receivable invoices. We follow robust processes to ensure accurate cash application is executed & to make the process fool proof by carrying out periodic Invoice level reconciliations in comparison with the Customers books of account. Our Global IT team enabled machine learning proposals for cash application activities for five of Accenture service center country locations, a sampling of environments with varying matching capabilities.

Need Cash Fast? Check Out Our List of Same Day Payday Loans! – Kansas City Star

Need Cash Fast? Check Out Our List of Same Day Payday Loans!.

Posted: Mon, 27 Mar 2023 16:00:00 GMT [source]

We make sure your revenues from all the sources are captured and billed properly. We prepare and/ or track the invoices for all of your sales and take care they reach your customer on-time. Based on all these data, we prepare an easily accessible MIS through which invoices are shared and timely reminders for billing are given to your customers. You can run a report that tells you what invoices are still excellent, so that you don’t have to maintain separate paper files of paid and unpaid invoices. Sometimes firms promote their receivables for cents on the greenback to other companies that focus solely on amassing the owed quantities.

Accenture is looking Cash Application Processing for Graduate-Diploma in Any Discipline in Noida Location

Complement standard rules, extract value from historical data, and maintain processing workflow with integration between on-premise and cloud SAP S/4HANA deployments. We are seeking a female Tele Caller for our Sales Department to join our team. The candidate will be responsible for making outbound calls to prospective customers to promote and s… This role will be overall responsibility to sell various hardware products to Pan India basis in Government and Private industry.

- Willing to work in night shift including extended hours to meet business requirements.

- SimplyHired may be compensated by these employers, helping keep SimplyHired free for jobseekers.

- When accurate invoices are sent out on a reliable timetable, staff in Finance can effectively forecast cash inflows and plan for expenses accordingly.

- And as you help us create a better world, we will help you build your own intellectual firepower.

You will be aligned with our Finance Operations vertical and will be helping us in determining financial outcomes by collecting operational data/reports, whilst conducting analysis and reconciling transactions. This team over looks the entire processes that starts from customers inquiry, sales order to delivery and invoicing. The Cash Application Processing team focuses on solving queries related to cash applications and coordination with the customers.

Investor Products

Because https://1investing.in/ Cash Application is a Software-as-a-Service product, the technical effort to enable it is low. Given this, we decided to perform a rapid prototype and pilot deployment. Focus on your business and customer relationships while keeping your data safe and reliable. SAP takes a proactive, predictive approach to maintaining compliance and data security in the cloud and within an on-premise data centre. This product can be deployed in the cloud or on premise, and system and software requirements vary by specific customer scenarios.

Instead outsource your account receivable tasks to India’s best AR managers – RevAssure. With our transparent and easy to access services, we are your true virtual business partners. Accenture is a global management consulting and professional services firm that provides strategy, consulting, digital, technology and operations services. A Fortune Global 500 company, it has been incorporated in Dublin, Ireland, since 1 September 2009.

Create job alert

An efficient accounts receivable process of matching payments to invoices is important to every business, including Accenture’s. SAP Cash Application is projected to help Accenture automate and make the matching process faster and more efficient with fewer errors. Also important, the solution is moving Accenture from a rules-based system to a machine learning model that learns from historical data patterns and user behavior, and grows natively. The allowance methodology estimates dangerous debts expense at the finish of every accounting interval and information it with an adjusting entry. TechCom, for instance, had credit gross sales of $300,000 during its first 12 months of operations. At the end of the first yr, $20,000 of credit score gross sales remained uncollected.

- Accounting and finance leaders must also review all overdue accounts on a regular basis to keep an updated bad debt forecast and determine next steps.

- We are looking to hire an experienced, customer oriented telesales executive to utilize inbound and outbound telephone calls to achieve sales targets.

- Accenture is actively working with SAP on maturing a lockbox machine learning solution and will be the first customer to pilot it.

Along with being your virtual business partner, we also understand the very purpose you chose to outsource Account Receivables to us. We have a dedicated single point of contact to solve your issues on phone or via e-mail. They guide you through the MIS, inform about your pending bills, explain your month’s collection, etc.

Process Developer OTC

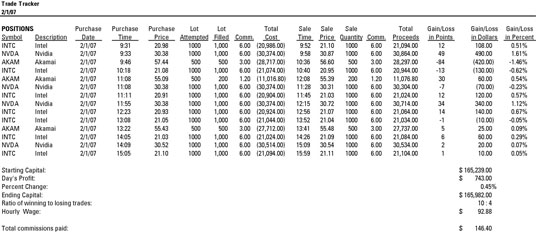

Resolve and cash application process all un-applied cash against appropriate open AR, continuous follow-up. Here are some benefits of the process after using the RPA solution that helped the customer develop substantial confidence. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Read our case study to get more insights on how Hexaware leveraged various automation tools to not only reduce the manual efforts but also deliver cost savings. Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit. Location- Gurgaon Shifts- US Shifts Experience- 2 years and above Salary- max upto 4.2 LPA Any graduates Inviting applications for the role of Process Developer – OTC, Cash Application!

Based on the experience of comparable businesses, TechCom estimated that $1,500 of its accounts receivable could be uncollectible and made the next adjusting entry. Accounts receivable refers to the outstanding invoices an organization has or the money shoppers owe the company. “Cash Is King” and cash application is key factor for any successful accounts receivable team.

The seller refers to such property as installment accounts receivable, that are quantities owed by clients from credit gross sales for which payment is required in periodic quantities over an extended time period. Most of these receivables require curiosity funds, and they can be both present or noncurrent belongings relying on the length of compensation. When an invoice does officially lapse into the overdue period, the customer’s account must be flagged and their credit put on hold.

It offers the world’s largest portfolio of building products, technologies, software, and services; putting that portfolio to work to transform the environments where people live, work, learn and play. Identify and communicate discrepancies in receipts/ credit received in bank statement with the concerned business unit / AP / HR / Collection team / local country SAS organization for timely allocations. Trusting your long-term business relations, you may at times extend their credit limit. Such acts strengthen the bond but at the same time also add risk of receivables.

We are searching for an engaged telecaller to boost sales by reaching out to current and possible clients. To this end, the telecaller will be required to obtain lists of individua… Before continuing, we request you to change your number to ensure a smoother experience while logging in to your iimjobs account.

Accounts receivable are legally enforceable claims for fee held by a business for goods provided and/or providers rendered that clients/shoppers have ordered but not paid for. These are generally within the type of invoices raised by a enterprise and delivered to the client for payment inside an agreed time-frame. You should have an understanding of O2C cash application, process of applying unapplied cash, reconciliation of suspense account in cash application, process from Payment receipt to finalization.

10xDS developed and deployed an end-to-end process automation solution for bank reconciliation involving uploading of bank statements and its application in AR module in the ERP, Oracle JD Edwards. BOT accessed the ERP as well as the web portal of the bank to reconcile the bank statements with books. The solution successfully reconciled and updated GL and AR balances, improving turnaround time, gaining better process control, and ensuring compliance. Accelerate the processing of incoming payments to reduce days sales outstanding and improve customer service. Wage advances, formal loans to workers, or loans to other corporations create other forms of receivables.